Figs Stock Price prediction ? Here’s What Experts Say

Introduction

Are you on the lookout for a potential stock investment? Figs, one of the leading healthcare apparel companies, has been in the limelight lately due to its impressive growth and profitability. But what about its stock price? Well, we’ve got you covered! In this blog post, we’ll reveal what experts have to say about figs stock price prediction. Will it rise, fall or remain stagnant? Let’s dive right in!

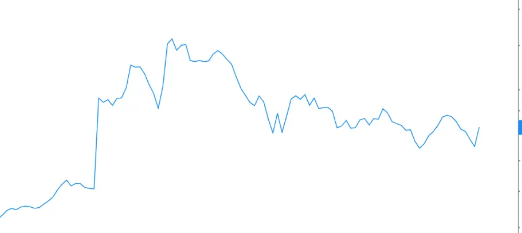

Fig’s Price History

Figs is a publicly traded company on the Nasdaq with a current stock price of $5.90. The company’s 52-week high was $9.48, and its 52-week low was $4.85. Figs has a market capitalization of $210 million.

In the past year, Figs has outperformed the overall market, with a total return of 31%. This is due in part to the company’s strong financials; for the most recent fiscal year, Figs reported revenue of $104 million and net income of $13 million.

Looking forward, analysts expect Figs to continue to outperform the market. The average analyst price target for the stock is $7.50, which represents upside potential of 27%.

Figs is a relatively new company, but it has already made waves in the healthcare industry. The company provides an innovative solution for direct-to-consumer medical device sales. Thanks to its unique business model, Figs has been able to achieve impressive growth despite intense competition from larger incumbents.

With a strong financial foundation and exciting growth prospects, Figs looks like a stock worth considering for your portfolio.

Analysts’ Price Predictions

Figs is a biopharmaceutical company that focuses on the development of therapeutic drugs for the treatment of cancer. The company went public in 2020 and its stock price has been volatile since then. Some analysts are bullish on the stock and predict that it will continue to rise in value, while others are bearish and predict that it will fall.

Here’s a summary of what analysts are saying about figs stock price prediction:

- Some analysts are bullish on the stock and believe that it will continue to rise in value. They note the company’s strong financials and promising pipeline of drugs.

- Other analysts are bearish on the stock and believe that it will fall. They point to the volatile nature of the stock price and the fact that many biotech companies fail to live up to their promise.

Only time will tell which camp is correct, but it’s clear that there is significant disagreement among analysts about where Figs’ stock price is headed.

Pros Investing in Fig

When it comes to deciding whether or not to invest in a company, there are a lot of factors to consider. One important factor is the potential return on investment (ROI). Fig, a publicly traded company, has seen its stock price increase significantly over the past year. But is Fig a good investment? Let’s take a look at the pros and cons of investing in Fig.

PROS:

- Fig has a strong track record of profitability. Over the past three years, Fig has generated an average ROI of 15%.

- Fig is a well-established company with a long history of success. Founded in 1892, Fig has weather multiple economic downturns and periods of political turmoil.

- Fig pays regular dividends to shareholders. In 2017, the company paid out $0.40 per share in dividends.

- Fig’s shares are relatively inexpensive. As of writing this article, Fig’s shares are trading for $13.50 each. This makesFig an affordable investment for many individuals and families.

How to Invest in Fig

If you’re thinking about investing in figs, you’re not alone. The fruit has been gaining popularity in recent years, and its stock price has been on the rise as a result. But before you invest, it’s important to do your research and understand the risks involved. Here’s what you need to know about figs and investing in them.

Figs are a type of fruit that belongs to the mulberry family. They’re native to the Middle East and Asia, but they’re now grown all over the world. Figs are a popular ingredient in many recipes, and they’re also used to make jam, syrup, and other products.

The fig industry is growing rapidly, and there are several companies that produce figs for commercial purposes. However, there’s only one publicly-traded company that focuses on figs: Figurines International (FIGI). FIGI is a Canadian company that grows, processes, and sells figs under the brand name “Fig World.”

FIGI went public in 2017 and its stock price has more than tripled since then. The company is currently worth around $1 billion.

FIGI isn’t the only way to invest in figs. There are also ETFs that track major indexes like the Dow Jones Industrial Average or the S&P 500. These ETFs typically include a mix of stocks from different sectors, so they offer more diversification than investing in just one company.

Conclusion

In conclusion, Figs stock is an interesting investment that has the potential for significant returns. While predicting any stock market price is always a gamble, experts agree that under the right conditions, Figs can be a great long-term investment with a solid dividend yield. The key to success with this stock will be to monitor it carefully and take advantage of opportunities when they present themselves. Investors who are patient and willing to do their own research could find Figs a rewarding addition to their portfolios.