Matic Price Prediction 2030: What To Expect From The Cryptocurrency Market

Cryptocurrency has become increasingly popular investment option in recent years, as it offers a wide variety of potential returns. Many investors, both experienced and new to the market, are anxious to learn more about the future of cryptocurrency, particularly when it comes to Matic price prediction 2030. In this article, we will explore current landscape of the crypto market and what investors can expect from Matic in terms of price predictions for the year 2030. We will also discuss some of the factors that may impact future Matic prices and how investors can best position themselves to capitalize on any potential gains. Read on to discover more!

What is Matic?

Matic Network is Layer 2 scaling solution that achieves scalability by using an adapted version of Plasma with PoS based side chains. Matic Network’s core product is its Plasma-based sidechain, which it developed to provide scalable solutions for Ethereum. The idea behind the project is to help Ethereum scale without compromising on decentralization or security.

The Matic team has been working on the project since mid-2017 and has made significant progress in terms of development and adoption. The team has also secured partnerships with some of the biggest names in the crypto space, including Binance, MakerDAO, and Kyber Network.

So far, the project seems to be on track and is well positioned to benefit from the growing demand for scalability solutions. In this article, we will discuss Matic Network price prediction for 2020 and see what the future holds for this promising project.

The Different Types of Matic

Matic is a type of cryptocurrency that is based on the Ethereum blockchain. It is used to power the decentralized applications (dApps) on the Ethereum network. Matic can be used to pay for transaction fees and gas costs. It can also be used to buy goods and services.

There are two types of Matic: ERC20 and ERC721. ERC20 is the most common type of Matic. It is used to represent tokens on the Ethereum network. ERC721 is a newer type of Matic that represents non-fungible tokens (NFTs). NFTs are unique digital assets that cannot be replaced or duplicated.

Matic can be bought and sold on exchanges such as Binance, Huobi, and OKEx. It can also be purchased with other cryptocurrencies such as Bitcoin and Ethereum.

Pros and Cons of Matic

Matic is a layer-2 solution that uses sidechains to scale the Ethereum network. Matic provides developers with a platform to build and launch dapps with near-instant finality, without compromising on decentralization or security.

The Matic team is led by experienced professionals with proven track record in building scalable platforms. The team is backed by well-known investors in the cryptocurrency space, including Coinbase Ventures, Binance Labs, and OKEx.

Matic has some clear advantages over other scaling solutions, including its high throughput and low transaction fees. Additionally, Matic is fully compatible with existing Ethereum tools and infrastructure.

However, Matic also has some drawbacks. One potential concern is that Matic could centralize power within the hands of miners and large stakeholders. Additionally, Matic’s use of Plasma could lead to security issues if not implemented correctly.

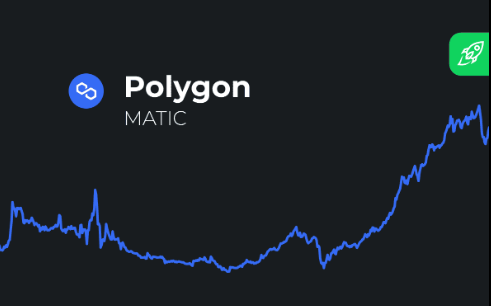

What is the price prediction for Matic in 2030?

In 2030, Matic price is expected to reach $28.74. The cryptocurrency market is full of uncertainties and predicting the future prices of cryptocurrencies is a difficult task. However, Matic has shown promising growth in past few years and is expected to continue growing in future. Matic has a strong community backing it and has partnered with some biggest names in industry. With its increasing adoption, Matic is expected to grow exponentially in the coming years.

How to invest in Matic

If you’re looking to invest in Matic, there are a few things you should know. First, Matic is a decentralized platform that uses Ethereum’s blockchain technology to offer scalability and security solutions for dapps. Second, Matic has its own token, which is used to power the platform and can be bought and sold on exchanges. Finally, Matic is an emerging project with a lot of potential; its price could rise significantly in the future.

Here’s a step-by-step guide on how to invest in Matic:

- Research the project and understand the technology. Before investing in any cryptocurrency, it’s important to do your own due diligence. This means reading about the project, understanding the use case for the token, and assessing the team’s experience and ability to execute their roadmap.

- Buy Matic tokens on an exchange. Once you’ve decided that you want to invest in Matic, you can buy MATIC tokens on an exchange like Binance or KuCoin. If you don’t already have cryptocurrency, you’ll first need to buy BTC or ETH; most exchanges don’t accept fiat currency (USD, EUR, etc.).

- Hold your tokens in a secure wallet. Once you have purchased MATIC tokens, you’ll need to store them in a secure wallet. We recommend using a hardware wallet like the

Conclusion

Matic price prediction 2030 is difficult to make due to its volatility. However, if the current market trends are anything to go by, Matic will be one of the major players in the cryptocurrency space over the next decade. With increasing demand and adoption amongst users as well as investors, it is expected that its value will continue to grow steadily year on year. As such, it may be wise for long-term investors to consider adding Matic tokens into their portfolios now before its price starts increasing rapidly in 2021 and beyond.